The Only AI Built on Your Entire Advisory Practice

CircleBlack AI connects every piece of critical advisor data and combines it with the macro, portfolio, and human context relevant to each client. And it does so natively, without integration hassle or added expense.

AI-Powered Wealth Management

CircleBlack AI is the connective tissue between the core advisor capabilities, the workflows that enable them, and the data that underpins them

Built Into the Advisor Data Layer

CircleBlack AI draws insights and workflows from a complete and reconciled advisor dataset that spans all core capabilities: portfolios, CRM activity, documents, emails, and plans all lives connected in one platform.

End-to-End, Not One-Off Tasks

With all advisor capabilities in a single platform, CircleBlack AI automates full cross-application workflows—from portfolio analysis to CRM follow-up—rather than automating isolated clerical tasks.

No Additional Fees, Tools, or Integrations

CircleBlack AI requires no extra tools, subscriptions, or integrations. Advisors avoid the time, expense, and complexity of connecting bolt-on solutions to their existing core WealthTech platforms.

Introducing The Portfolio Agent

CircleBlack AI’s first priority is eliminating the manual lift advisors face in preparing, organizing, and presenting client portfolio data.

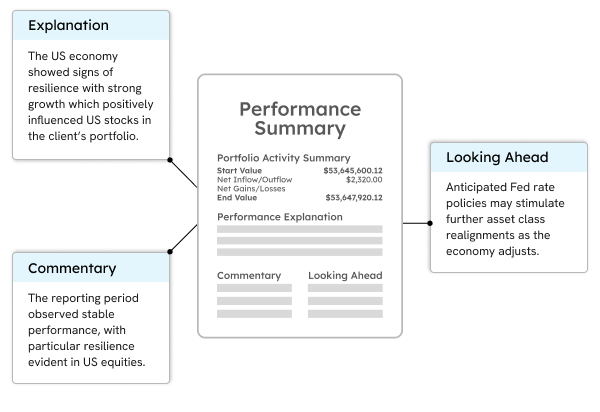

AI-Powered Performance Insights

Generates client-ready and advisor-ready summaries in minutes

Explains the real drivers of gains and losses

Blends portfolio data with trusted financial market sources

Builds insights from a unified, reconciled advisor dataset

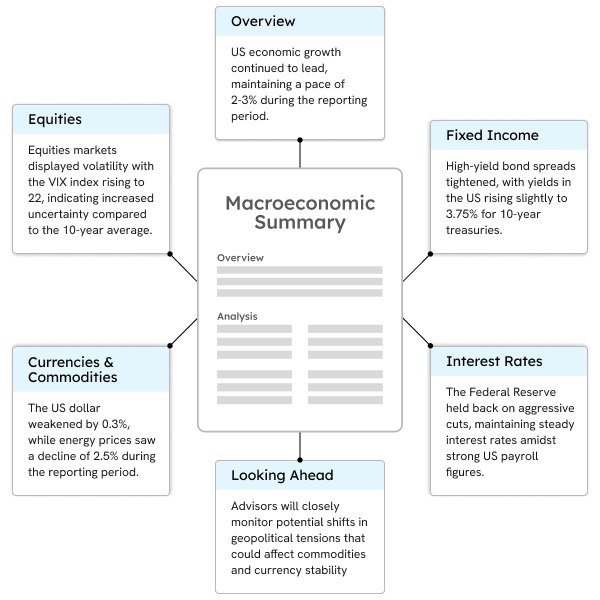

AI-Powered Macroeconomic Insights

Identifies the macro forces shaping each client’s portfolio

Connects external events directly to holdings and performance

Aggregates insights from trusted market and economic sources

Generates concise, plain-language summaries, ready for client reporting or advisor prep

CircleBlack's AI Roadmap

CircleBlack AI is not a single tool or feature, but a cross-application enabler embedded across the platform; our roadmap spans every core advisor workflow, from reporting to CRM

Portfolio Reporting (Available Now)

Client- and advisor-ready performance summaries with market context and holdings analysis in seconds.

Customer Relationship Management

End-to-end meeting intelligence with automated agendas, summaries, and correspondence.

Document Management

Natural-language search for instant, compliance-ready access to statements, reports, and disclosures.

Practice Management

Advanced portfolio analytics with real-time monitoring, alignment reviews, and clear, goal-based insights.

Manager Selection

AI-powered manager and fund search, with diligence reports and ongoing monitoring to streamline oversight.

Portfolio Construction

Tailored prospect and client portfolios, model creation, and transition plans with compliance-ready outputs.

Portfolio Reporting (Available Now)

Client- and advisor-ready performance summaries with market context and holdings analysis in seconds.

Customer Relationship Management

End-to-end meeting intelligence with automated agendas, summaries, and correspondence.

Document Management

Natural-language search for instant, compliance-ready access to statements, reports, and disclosures.

Practice Management

Advanced portfolio analytics with real-time monitoring, alignment reviews, and clear, goal-based insights.

Manager Selection

AI-powered manager and fund search, with diligence reports and ongoing monitoring to streamline oversight.

Portfolio Construction

Tailored prospect and client portfolios, model creation, and transition plans with compliance-ready outputs.

AI-powered portfolio management starting at $550 a month

Starting at

$550

per month

$550

per month

Portfolio Management & CRM

Only the critical tools you need and nothing more; no overpaying for features you do not use

What’s included

Custodian & Heldaway Data Aggregation

Customer Relationship Management

Portfolio Reporting

Document Management

Practice Management

Investor Experience (Desktop & Mobile)

Client Billing