CircleBlack vs. Redtail: Which Makes More Sense for You?

Explore how CircleBlack’s native CRM stacks up against Redtail’s integrated CRM.

Why Advisors Compare CircleBlack and Redtail

Advisors would compare CircleBlack CRM and Redtail because both are positioned as CRM solutions for financial advisors, but they solve advisor needs in very different ways.

Redtail's Approach

Redtail treats CRM primarily as a relationship and activity management system: track who the client is, what has been communicated with them, and what tasks needed to happen with them.

vs.

CircleBlack's Approach

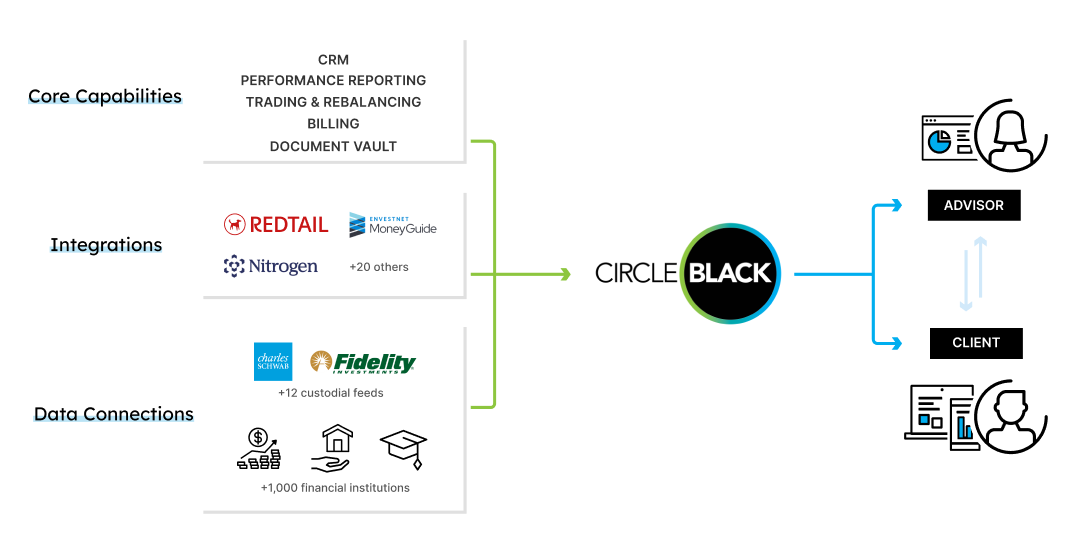

CircleBlack treats CRM as the authoritative client record, where the relationship, portfolio, performance, and workflows all run on the same data foundation.

In CircleBlack’s view, if CRM doesn’t understand the client’s financial reality, it can’t drive meaningful workflows.

Is CircleBlack or RedBlack a Better Fit for Your Firm?

We'll give you an honest assessment of which platform is better suited to your needs

CircleBlack is a great fit if you:

Are tired of switching between CRM, reporting, and planning tools

Seek a unified CRM, portfolio management, and financial planning experience

Want records, email, calendar, meetings, performance, planning, and documents in one interface

Look for CRM workflows triggered by assets or performance events, rather than just tasks

Redtailis a great fit if you:

Have CRM needs limited to contacts, notes, tasks, and reminders

Are comfortable keeping portfolio management and CRM in separate systems

Have primarily task-based, not data-driven, workflows

Want a CRM that tracks relationships without changing how you work

Simplify daily tasks and client interactions

Without CircleBlack

With CircleBlack

Tools, accounts, and files are siloed and scattered, making it challenging to see and manage a client’s portfolio holistically.

One central platform for advisors & clients to access all their data, accounts, and files.

Connect the tools you already use all in one platform

With CircleBlack, seamlessly integrate with 25+ best-in-class WealthTech, AdvisorTech, and FinTech solutions — spanning CRM, planning, trading, billing, and compliance — plus connect to over 17,000 financial institutions, all within a single platform.

AI-powered portfolio management starting at $550 a month

Starting at

$550

per month

$550

per month

Portfolio Management & CRM

Only the critical tools you need and nothing more; no overpaying for features you do not use

What’s included

Custodian & Heldaway Data Aggregation

Customer Relationship Management

Portfolio Reporting

Document Management

Practice Management

Investor Experience (Desktop & Mobile)

Client Billing