CircleBlack vs. Black Diamond: Which Makes More Sense for You?

Explore how CircleBlack’s integration depth stacks up against Black Diamond’s breadth.

Why Advisors Compare CircleBlack and Black Diamond

Both tools serve as core operating systems for RIAs; Black Diamond emphasizes optionality through broad integrations, while CircleBlack embraces integration depth and tightly integrated workflows.

Black Diamond's Approach

Core portfolio management with broad integration optionality.

Black Diamond delivers portfolio management and reporting, built around wide connectivity across the WealthTech ecosystem and multiple CRM options that integrate alongside the platform—prioritizing flexibility and choice over deeply embedded, end-to-end workflows.

vs.

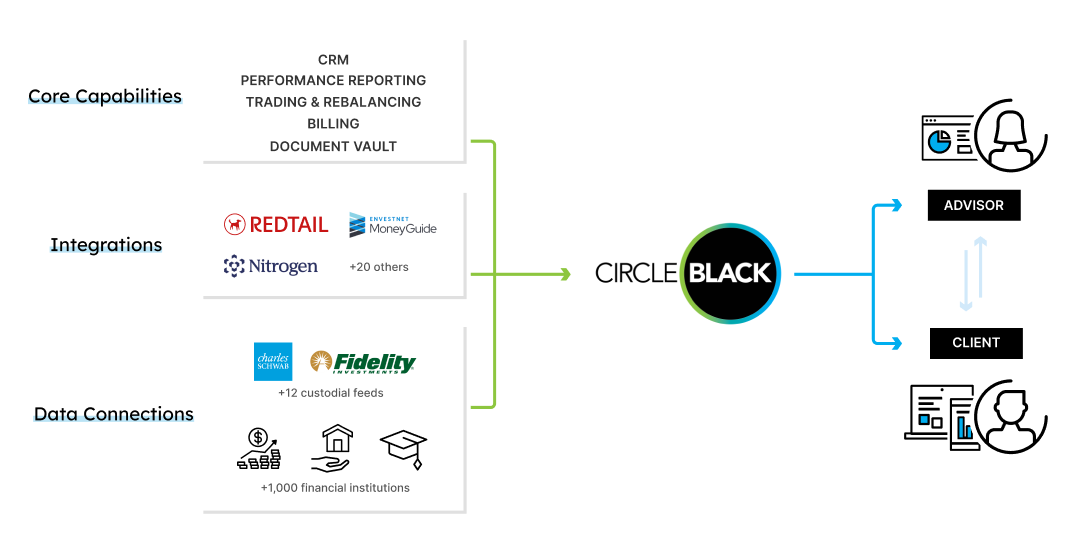

CircleBlack's Approach

A reporting platform natively intertwined with a Salesforce-powered CRM.

CircleBlack’s core offering tightly integrates portfolio management, reporting, and CRM at the system level, with deep, interoperable, two-way integrations that connect planning, trading & rebalancing, risk, compliance, and other advisory tools directly into those core workflows.

Is CircleBlack or Black Diamond a Better Fit for Your Firm?

We'll give you an honest assessment of which platform is better suited to your needs

CircleBlack is a great fit if you:

Want deep, two-way integrations between your core reporting platform and best-in-class risk, planning, trading, and compliance tools

Seek a Salesforce-powered CRM natively integrated alongside portfolio data, rather than a separate CRM application or integration

Value a dedicated support manager who actively supports onboarding, adoption, and ongoing success

Need custodian-agnostic data ingestion with broad coverage and real-time synchronization

Black Diamond is a great fit if you:

Value broad integration coverage across a wide range of WealthTech providers, even if most integrations are one-way

Prefer CRM optionality, with multiple CRM solutions that integrate alongside your portfolio platform

Prioritize standardized, firm-wide portfolio reporting designed for consistency and scale

Are comfortable with a primarily email-based support model rather than a dedicated representative

WealthTech Integration Score

The Ezra Group WealthTech Integration Score™ is built on a 10-point scale which is designed to evaluate the robustness of an application’s external integrations.

CircleBlack

8.09

Tamarac

7.98

Black Diamond

7.53

Addepar

6.52

Advyzon

6.13

Simplify daily tasks and client interactions

Without CircleBlack

With CircleBlack

Tools, accounts, and files are siloed and scattered, making it challenging to see and manage a client’s portfolio holistically.

One central platform for advisors & clients to access all their data, accounts, and files.

AI-powered portfolio management starting at $550 a month

Starting at

$550

per month

$550

per month

Portfolio Management & CRM

Only the critical tools you need and nothing more; no overpaying for features you do not use

What’s included

Custodian & Heldaway Data Aggregation

Customer Relationship Management

Portfolio Reporting

Document Management

Practice Management

Investor Experience (Desktop & Mobile)

Client Billing