Diversified Capital Group Offers Seamless Client Portal

15-25%

6

2%

About Diversified Capital Group

Diversified Capital Group is an independent investment advisory firm based in the Bay Area, California. Uninfluenced by corporate agendas, Wall Street, and investment banks, it prides itself on honest advice that preserves and grows its clients’ wealth.

AUM

The Challenge

Born out of the need to help, Paul Laughton founded Diversified Capital Group in 2007 to care for its clients and their wealth. Soon after, he realized that building a financial advisory firm that could stand the test of time was his true calling.

When Laughton’s son, Cole, joined Diversified Capital to continue his legacy, they made CircleBlack the cornerstone of that transformation. Their goal was simple: use technology that could deliver a high level of client care and adapt to changing times.

The Solution

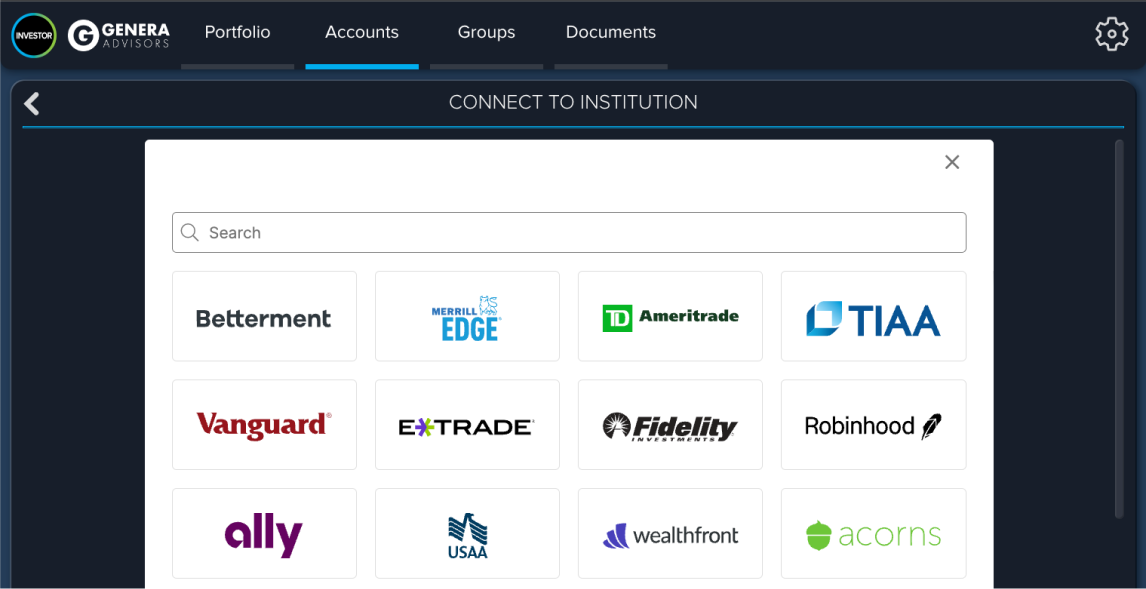

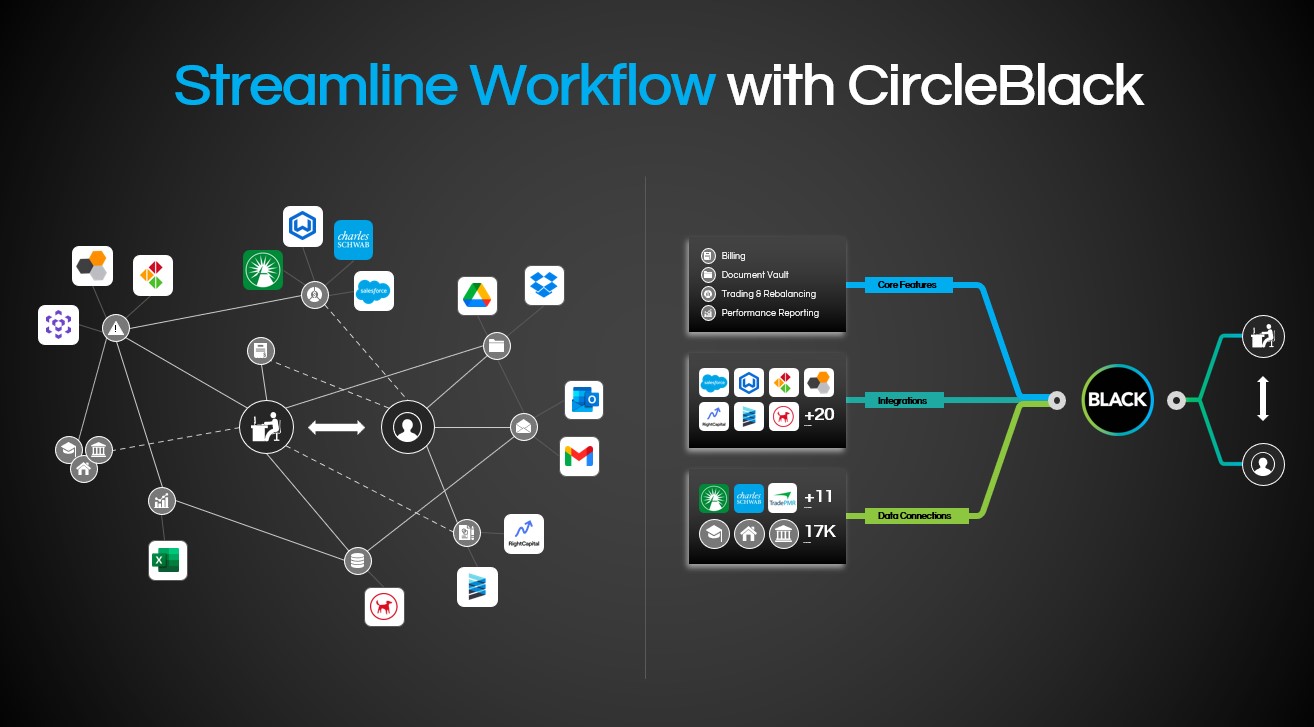

After a great deal of research and reviewing a range of technologies, Cole found his way to CircleBlack and the supporting network of AdvisorTech integration partners. He chose the best tools based on the needs of his firm, building the right tech stack for his team.

“[Cole’s] first project was to develop a technology platform that could help service and grow our business into the future, as well as assist our clients with their needs and desires,” says Paul Laughton, founder of Diversified Capital Group.

- Unified Wealth Management System

- Quick Onboarding

- Proactive Customer Service

- Diverse Technology Stack

Quick Onboarding

It took Divsersified Capital Group under 48 hours to be up and running with CircleBlack – from signing a contract, to connecting with Schwab’s custodial feed, to setting up two third-party integrations and beginning to utilize the CircleBlack platform.

The CircleBlack Customer Success team ensured the transition went smoothly and that Laughton was ready to leverage the platform. Like 100% of our users, Laughton required under one hour of personal training to be able to use CircleBlack independently.

Complimentary biweekly checkins between CircleBlack and Diversified Capital Group continued for his first two months onboard the platform, a period of time in which Laughton reported feeling that the CircleBlack Customer Success team was professional, timely, and responsive to his firm’s needs.

Simplified, Intuitive Dashboard

Unifying and simplifying processes was vital to Diversified Capital’s technological update. CircleBlack’s all-in-one platform with easy integration was the perfect solution for both the advisory firm and its clients.

“CircleBlack has become the nucleus for our fintech, allowing us to aggregate everything into one dashboard,” says Laughton. “What drew me to CircleBlack was its intuitive user interface. This is the foundation we could build all other fintech software in and through. In short, it is our home base.”

Proactive Customer Service

CircleBlack operates as an extension of Diversified Capital’s in-house team. To ensure seamless integration, CircleBlack went the extra mile to contact a third-party software provider on their behalf.

This not only helped Diversified Capital utilize all its subscriptions, but it also benefitted CircleBlack by growing its technology stack and connections within the industry.

“CircleBlack’s Customer Support team took the initiative to troubleshoot the issue on our behalf. If we or our clients need extra support, we can lean on CircleBlack for assistance,” says Laughton. “It’s great to be able to work with a company we can trust to care for our clients the way we care for them.”

Measurable Time-Savings

Manual, repetitive tasks are as commonplace as they are time- and energy-draining at wealth management firms. Rather than hiring additional personnel, Diversified Capital Group leans into CircleBlack to automate much of their workflow and free them up for more time dedicated to each of their clients. Over the weeks, quarters, and years, the ability to make better use of time really adds up.

“Customizable reporting is my favorite feature of CircleBlack. It complements monthly client statements,” Laughton notes. “The key difference is in the aggregation of all accounts under one household. On average, this saves me 40+ hours of manual work every quarter.”

The time savings doesn’t stop there. Using CircleBlack’s seamless BillFin billing integration, Laughton shared, “It scales with client accounts and our relative pricing model. Overall, the BillFin API easily saves us 20+ hours of manual work on a quarterly basis.”

Disclosures: This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal, or tax advice.

See CircleBlack in Action

Grow your practice without hiring additional administrative or IT personnel. Deliver a superior client experience with unmatched efficiency. CircleBlack enables every advisor to become the best version of themself.