See how CircleBlack provides a seamless experience for a breakaway advisory firm to grow with speed and precision, while retaining 100% of its clients.

Performance Calculation

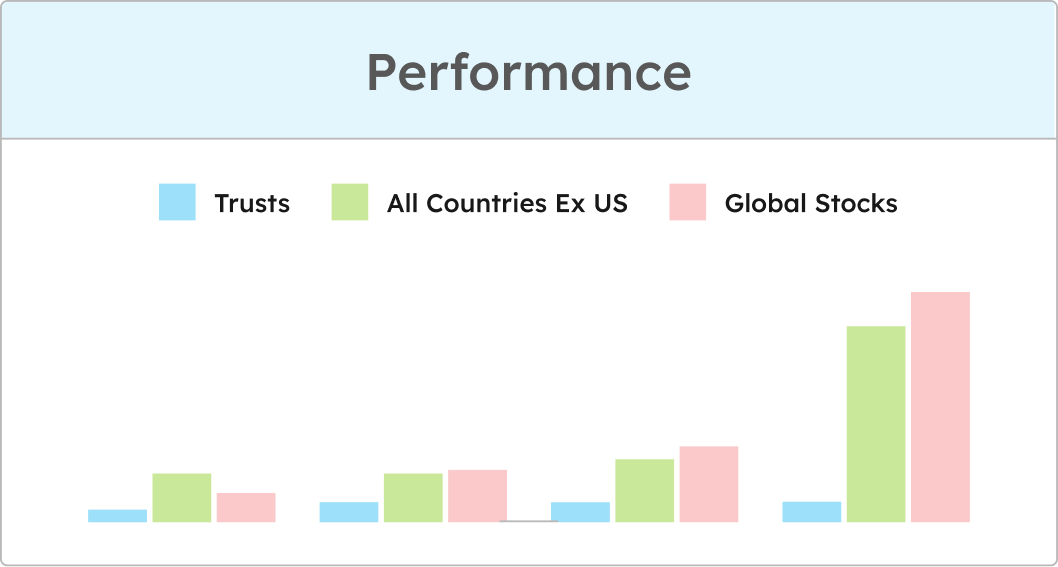

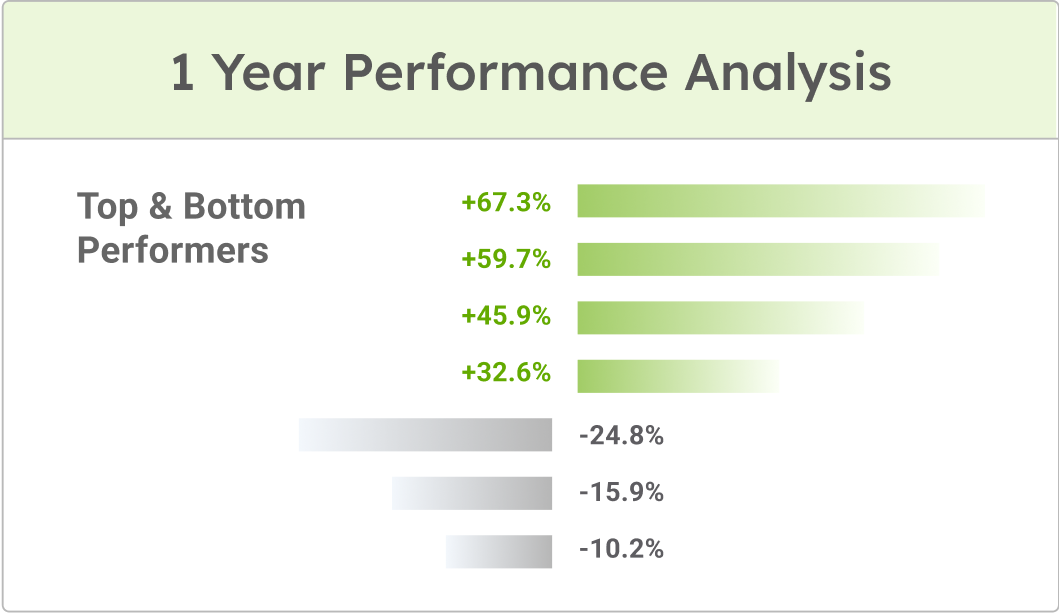

CircleBlack’s performance calculation engine delivers multi-level performance insights, enabling advisors to analyze returns by position, asset class, account, household, or any custom-defined grouping, shown net or gross of fees. Advisors can isolate top and bottom contributors and toggle between time-weighted and money-weighted returns. Layer on top a Performance X-Ray that reveals the daily values, cash flows, and fees behind every return, and the result is a foundation of explainability that makes every performance review simple.

Precision and simplicity in performance measurement

PERFORMANCE ANALYSIS

Performance measured and presented intuitively

Multi-level performance insights (TWR or MWR) that enable advisors to evaluate returns across positions, asset classes, accounts, and households—gross or net of fees.

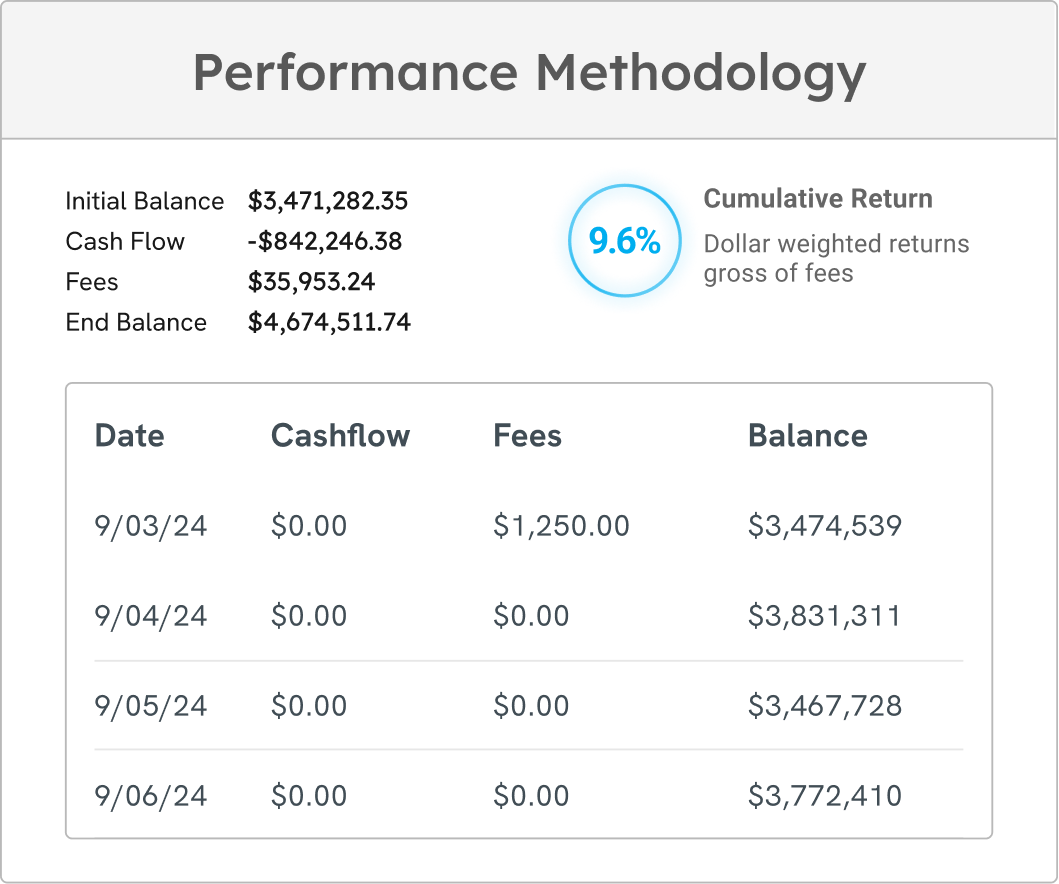

PERFORMANCE X-RAY

X-Ray visibility into underlying data

Full transparency into market values, cash flows, fees, and sub-period calculations behind every figure.

ATTRIBUTION & BENCHMARKING

Insights behind the returns

At a glance, advisors can identify top and bottom contributors—the holdings, asset classes, or allocations with the greatest impact on total performance—while benchmarking against relevant ETFs or blended indices.

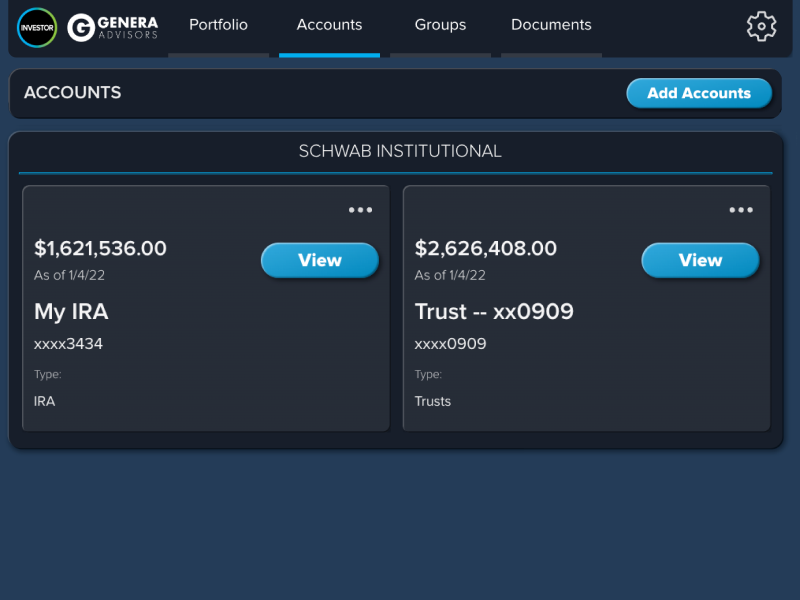

REPORT GROUPING

Report grouping that mirrors your portfolios

Flexible report grouping empowers advisors to organize performance across accounts, models, tax wrappers, or custom groupings—so reporting reflects real portfolio construction and management workflows.