See how CircleBlack provides a seamless experience for a breakaway advisory firm to grow with speed and precision, while retaining 100% of its clients.

CircleBlack AI

The outcome: client relationships and investment management are mastered, with market intelligence, portfolio insight, and the client relationship understood as one.

CircleBlack AI is the connective tissue between the core advisor capabilities, the workflows that enable them, and the data that powers them.

Introducing CircleBlack AI’s Portfolio Agent

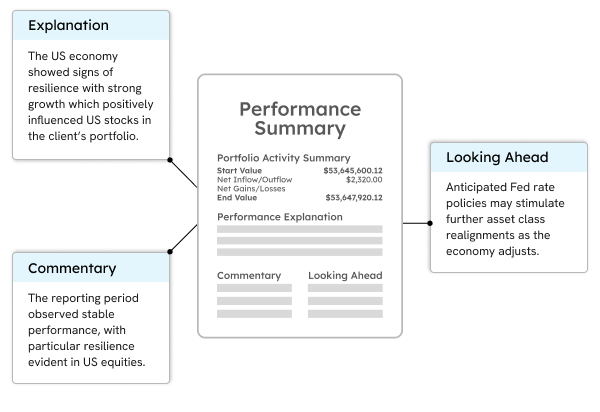

CircleBlack AI’s first priority is eliminating the manual lift advisors face in preparing, organizing, and presenting client portfolio data. Today, advisors must cross-reference performance data with trusted financial and macroeconomic sources such as Barron’s or the Financial Times and manually weave that context into client-ready reports.

Now, you no longer need to worry. CircleBlack AI automates the process with AI-Powered Portfolio and Macroeconomic Insights

AI-Powered Portfolio Insights

CircleBlack AI’s Portfolio Agent eliminates this inefficiency by automatically analyzing a client’s portfolio performance, pulling insights from the advisor’s preferred sources, contextualizing performance drivers, and generating a complete client-ready report in minutes.

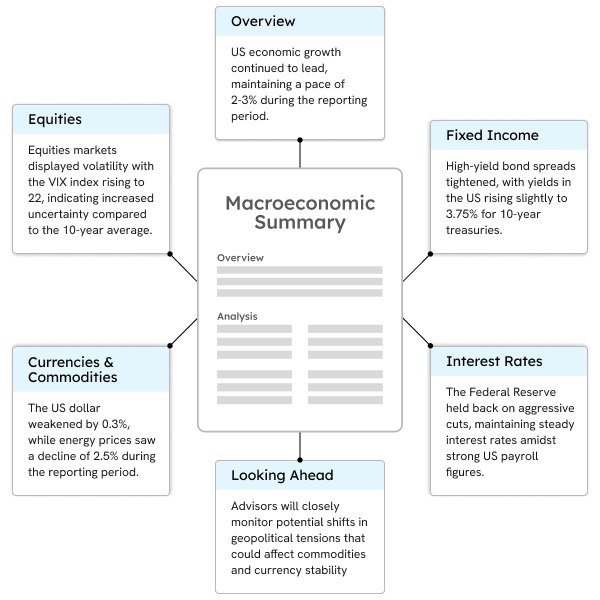

AI-Powered Macroeconomic Insights

The same philosophy applied to performance will extend to macroeconomic outlook. From interest rates and inflation to geopolitical events, advisors can instantly explain how external forces affect key portfolio positions and include these insights in client-ready reports within minutes.