See how CircleBlack provides a seamless experience for a breakaway advisory firm to grow with speed and precision, while retaining 100% of its clients.

Portfolio Reporting

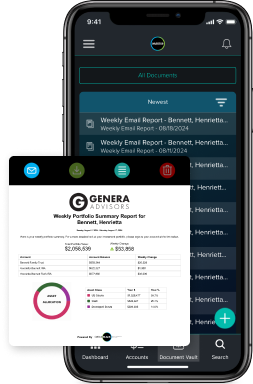

CircleBlack Portfolio Reporting is an automated report builder where advisors can choose from pre-built templates or design fully custom, client-ready reports, both created in minutes and shared instantly through the platform. What advisors design is exactly what clients receive, and the configuration workflow is built for advisors, not graphic designers. Together, these capabilities centralize all reporting needs in one place, without extra costs or complex integrations.

Generate account summaries in minutes

40%

Reduction in report preparation time through automated report generation

20%

Reduction in inbound client questions through self-service tools

10 hrs

Saved quarterly on reports with AI-powered personalized reporting

Generate account summaries in minutes

40%

Reduction in report preparation time through automated report generation

20%

Reduction in inbound client questions through self-service tools

10 hrs

Saved quarterly on reports with AI-powered personalized reporting

Why CircleBlack Reporting Wins

1. Design-True Output

Unlike other WealthTech tools, where report outputs often deviate from what the advisor designs,CircleBlack ensures that what you see while building is exactly what gets generated.

2. Flexible, Customizable Design

Configurable tables, saved views, adaptable templates, and CSV/Excel exports let advisors tailor reports to their exact design and delivery needs without relying on operations support.

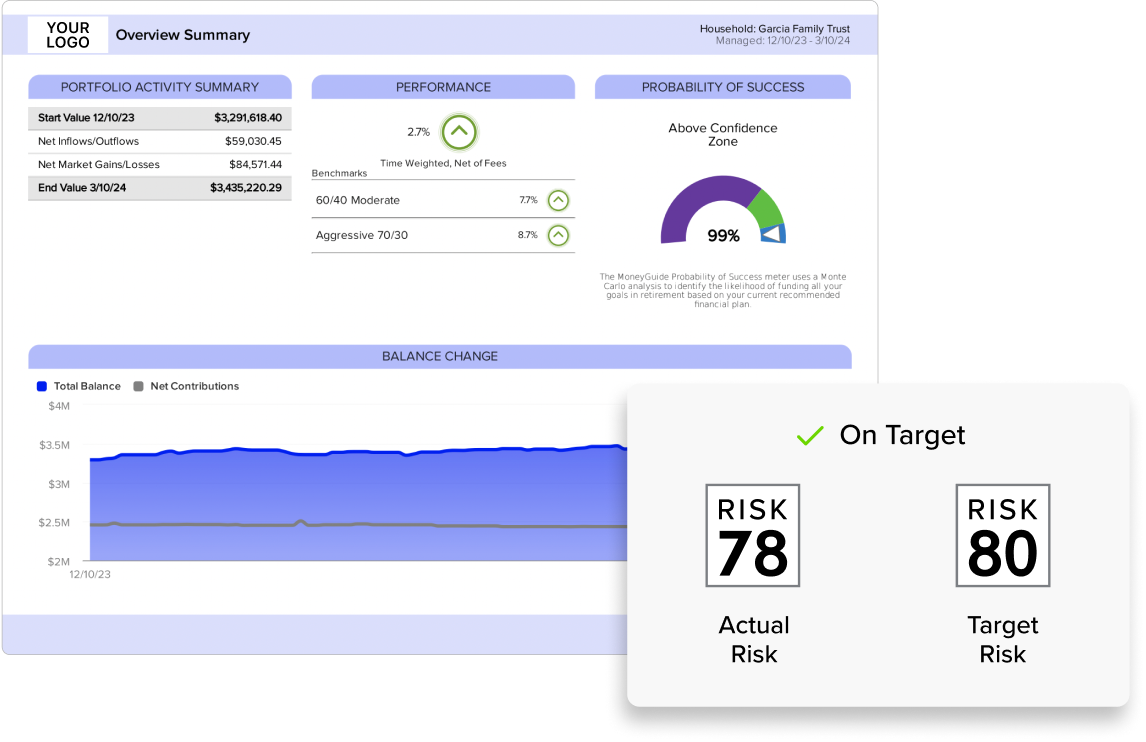

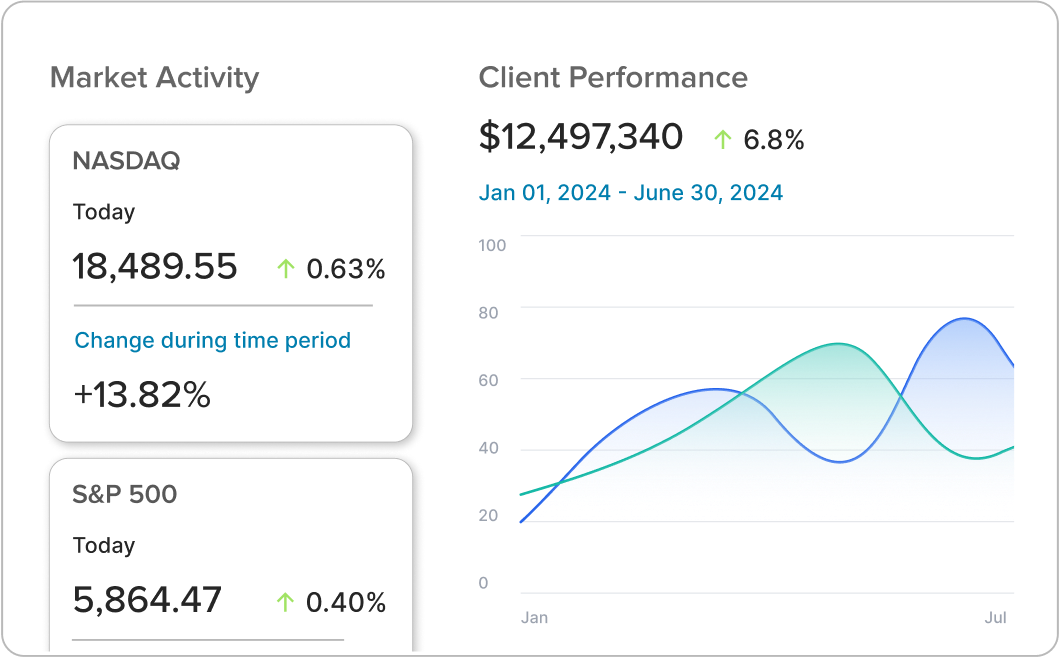

3. Transparent, Detailed Insight

Every report is fully explainable and traceable back to its source data, with transaction-level drilldowns, daily cash flow visibility, and clear separation of gains, losses, contributions, and fees.

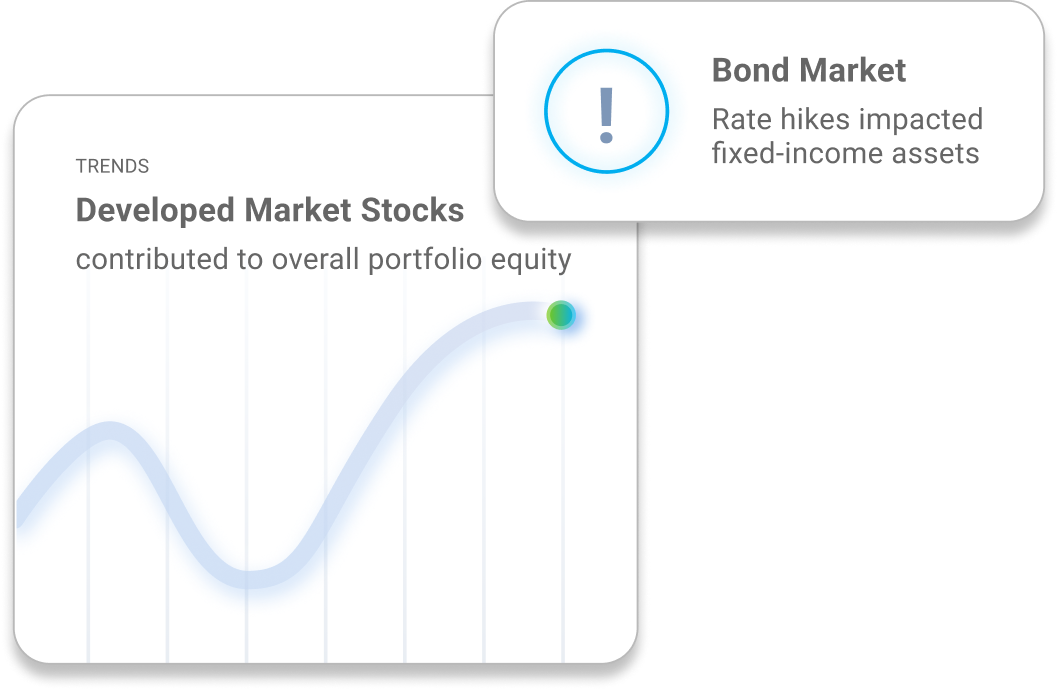

Practical, personalized portfolio management enhanced by AI

Report Builder

Build Reports Custom-Tailored

Ready-to-use report templates—covering Balance, Performance, Holdings, Income & Expense, General, and Exposure—deliver the reports advisors rely on most, eliminating hours of design and prep. Flexible customization options for layouts, fields, grouping logic, and branding enable firms to tailor reports precisely to their needs.

Transparency & Control

Know Exactly What You Are Showing Your Clients

What advisors build on screen is exactly what clients receive—no mismatches, no re-runs, no guesswork. Reports are generated exactly as designed. Our Performance X-Ray adds even more transparency, letting advisors drill into daily cash flows, fees, and performance drivers. With this clarity, advisors can explain every number with confidence.

Reporting Coverage

Generate Any Report You Need in Minutes

The result is a full spectrum of reports advisors rely on, spanning performance, cash and income, asset class, practice management, and compliance—all available for automated generation and delivered in minutes. Advisors can produce portfolio and position performance, value changes and account comparisons, income and expense breakdowns, realized and projected gains, billing and transaction summaries, and compliance-ready filings such as Form 13F and ADV—all from one platform.