Many Registered Investment Advisors (RIAs) face challenges in accurately reporting investment performance to clients, particularly in differentiating between annualized and cumulative returns. Misunderstandings lead to client confusion, increased risk, misplaced expectations, and potential dissatisfaction with investment strategies.

CircleBlack’s Performance Reporting functionality directly addresses these issues by providing clear options for calculating and displaying both annualized and cumulative returns. This allows advisors to tailor reports to the specific understanding levels and needs of different clients, ensuring clarity and precision in communication.

Understanding Annualized Reporting

Annualized reporting shows the average amount of money earned by an investment each year over a given time period. It is essentially a geometric average that represents the compound growth rate of the investments.

This method smooths out the returns of an investment over several years to provide a single figure that describes the average return per year. It allows investors to compare the performance of investments over different periods or against benchmarks that report in annual terms.

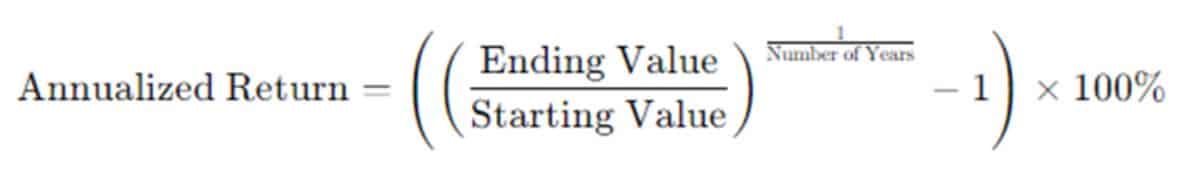

Calculating annualized returns without CircleBlack solutions can be a bit complex, especially when dealing with irregular cash flows (i.e. dividends, capital gains distributions) or multiple periods of investment. The annualized return takes into account the compounding effect of gains and losses over the period and is calculated using this formula:

Annualized returns provide a standard way to measure and communicate investment performance, helping to level the playing field among various financial products.

This allows for the comparison of performance across different investments and time periods, even if those investments have different durations. This comparability is crucial for RIAs when they need to demonstrate the effectiveness of their strategy relative to benchmarks or competing investments.

Annualized Returns are automatically calculated using CircleBlack WealthTech integrations

Understanding Cumulative Reporting

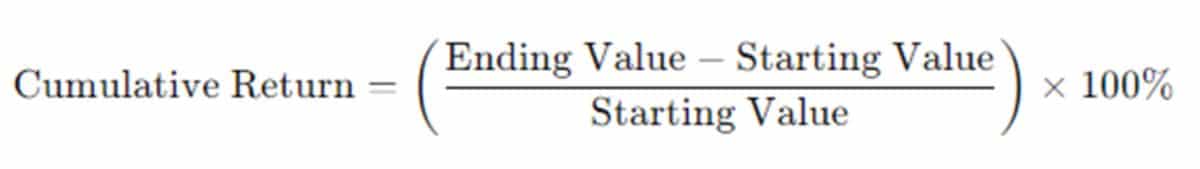

Cumulative reporting refers to the total aggregate return of an investment from the start date to the end date without annualizing the returns.

This represents the total percentage change in investment value over a period. This method shows the total return earned by an investment over the entire period it has been held. It reflects the overall growth or decline in investment value.

The calculation and understanding of cumulative returns are straightforward—how much the investment has grown or shrunk in total percentage terms from the start. CircleBlack calculates your clients’ cumulative returns with this simple formula:

Cumulative reporting shows the total effect of an investment decision over the entire period it has been held, which can be very impactful from a client’s perspective.

Cumulative Returns are automatically calculated using CircleBlack WealthTech integrations

Evaluating the Efficacy of Annualized vs. Cumulative Returns

The choice between annualized and cumulative returns in performance reports can significantly impact how investment performance is interpreted. CircleBlack’s platform provides an intuitive approach to selecting the optimal reporting methodology for any given scenario.

Annualized Returns:

Best suited for analyzing performance across periods longer than a year. This method annualizes returns, providing a normalized rate that can be compared across different time frames.

Annualized Reporting offers a clear picture of how investments would have performed on average, each year, over the specified period. This helps in assessing the performance of an investment manager or strategy over long periods, making it easier for investors to make comparisons irrespective of the investment duration.

- Benefit for Advisor: Annualized reports can aid in marketing and client presentations by showing a smoothed performance metric.

- May Mask Volatility: Annualized returns can sometimes obscure the volatility or risk of an investment by smoothing out the performance over time.

- Benefit for Client: Clients get a sense of average annual returns, which can help in long-term financial planning.

- Be Mindful of Misinterpretation: Clients might misunderstand annualized returns as the actual yearly returns received every year, rather than as an average return that accounts for compounding.

Cumulative Returns:

Ideal for capturing the total return over a specific reporting period, regardless of duration. This approach aggregates all returns from the start of the period, offering a straightforward snapshot of performance that is particularly enlightening for periods of less than a year.

Cumulative returns are markedly useful for understanding the total growth or drawdown of an investment since inception. They provide a clear picture of total gains or losses, which is critical for evaluating the overall effectiveness of an investment strategy.

- Benefit for Advisor: Allows the advisor to demonstrate the total value added or growth achieved through their management.

- Can Be Misleading During Volatile Periods: During highly volatile periods, cumulative returns might either overstate or understate the risk and volatility involved, depending on the market’s condition at the end and beginning of the period.

- Benefit for Client: Provides a clear, direct understanding of total gains or losses, which is easily relatable and understandable.

- Lack of Context: Cumulative returns don’t provide context on how long the investment was held, making it challenging to compare one investment’s performance against another over different time frames. It also does not reflect the time value of money or the effect of compounding, which can be crucial for assessing long-term investment growth.

For RIAs, the choice between using annualized or cumulative reporting can hinge on the specific needs of their client communications and the nature of the investments. Annualized returns might be more suitable in situations where an RIA needs to demonstrate consistent, long-term investment performance to clients or potential clients.

Cumulative returns might be more useful when the discussion is about the total growth of the funds from inception, which can be particularly effective in illustrating the success of long-term investment strategies during client reviews.

Key differences include:

- Time Adjustment: Annualized returns adjust for the time period, making them ideal for comparison across different time spans, while cumulative returns do not adjust for time and simply show the total change.

- Purpose of Comparison: Annualized returns are better for comparing the performance of different investments or managers, especially where the holding periods differ. Cumulative returns are more straightforward and are often used in client reports to show the actual growth of the invested money over time.

Both types of reporting serve different purposes and provide valuable insights depending on the context in which they are used. For RIAs, using both methods in client reports can provide a comprehensive view of how investments are performing.

Ultimately, this may be the best approach to help clients make more informed decisions while highlighting your strategic value in managing those investments effectively.

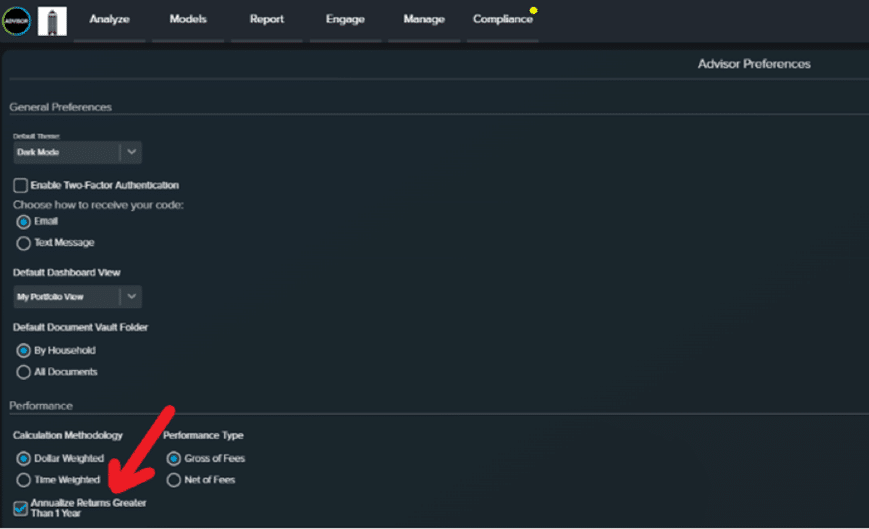

Tailoring Reports through the Advisor Portal

At the heart of CircleBlack’s platform is the Advisor Portal, where the selection between cumulative and annualized performance can be easily configured.

This portal not only offers a high degree of customization with widgets like Performance and Performance by Asset Class but also ensures that advisors can present performance data in the most relevant context to their clients.

Performance changes may be viewed on the following pages:

- Portfolio Overview

- Multi-Period Performance

- Accounts

- Asset Class Performance

- Asset Class Detailed Performance

- Holding By Account

- Holding By Asset Class

- Top & Bottom Performers

- Top & Bottom Contributors

Strategic Application in Reporting

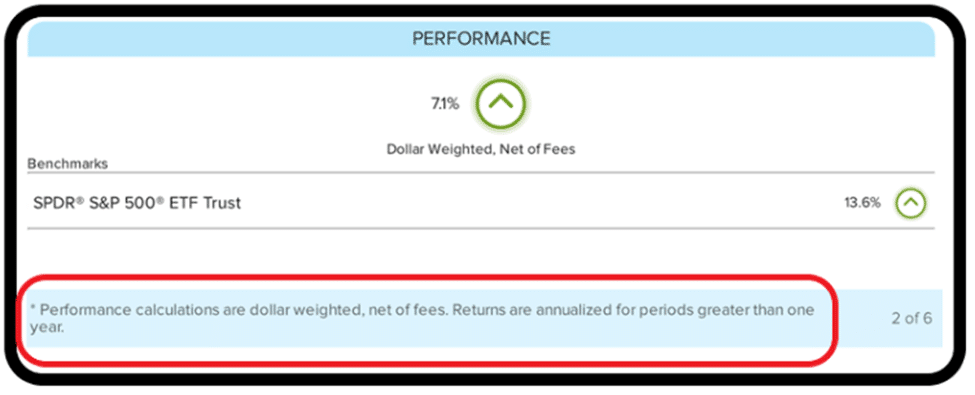

CircleBlack Performance Reporting provides options for calculating and displaying annualized vs. cumulative returns.

When selecting Cumulative Performance:

- Returns are calculated on a cumulative basis for all reporting periods, including for periods less than one year.

When selecting Annualized Performance:

- For periods less than one year, returns are calculated on a cumulative basis.

- For periods greater than one year, returns are annualized.

Periods under one year always show the cumulative performance. For periods greater than one year, you can select performance reports to display returns as annualized.

Real-World Use-Cases of Cumulative vs Annualized Reporting

Consider the scenario of a newly established advisory firm seeking to demonstrate its value to prospective clients with a concise portfolio performance summary. By opting for cumulative performance reporting, the advisor can highlight the portfolio’s total return since inception, making a compelling case for the firm’s investment strategy without the complexity of annualization calculations.

Conversely, for an established RIA managing a diverse portfolio over several years, annualized performance reporting can illuminate long-term trends and the effectiveness of the investment strategy, normalized across all periods. This approach is invaluable for clients with a strategic focus on consistent growth.