The RIA space keeps getting more crowded with clients expecting more than ever.

How can your firm stay ahead?

This roundup breaks down where the industry is heading: how firms are growing, what clients expect, how technology’s shifting, and what it means for your margins.

Leverage these RIA industry statistics to anticipate industry shifts and make strategic decisions that keep your advisory ahead of the curve.

RIA Growth & Competition Stats

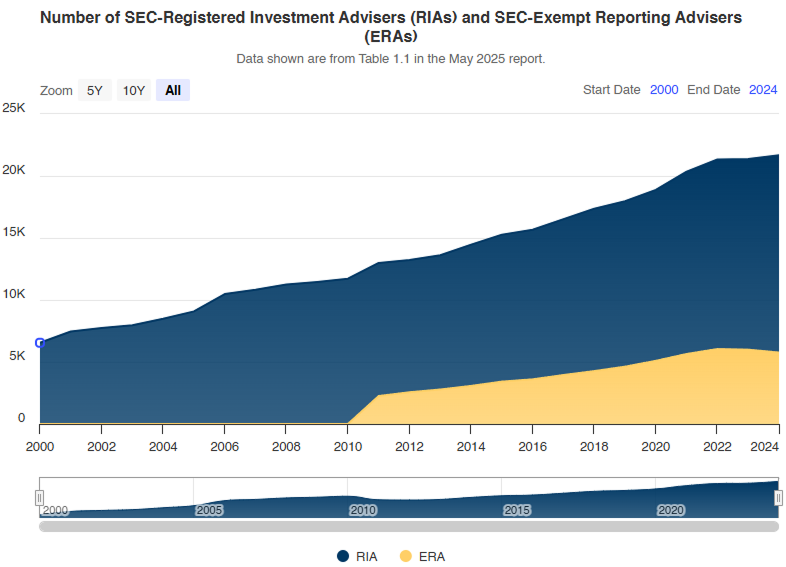

The U.S. Registered Investment Advisor (RIA) market isn’t slowing down. And higher competition is expected heading into 2025 simply due to more advisors in the field.

- The number of SEC-registered investment advisory firms in the U.S. reached an all-time high of 26,669.

- Likewise, the number of clients served by SEC-registered advisors hit 68.4 million in 2024 (up ~6.8% from ~64 million in 2023).

- By 2026, RIAs are projected to manage roughly 33% of all advisor-managed assets in the U.S., reflecting the rapid rise of the independent advisory model.

Source: SEC, Investment Adviser Statistics (staff visualizations of Form ADV data)

RIA Mergers and Acquisitions Data

Established firms are increasingly pursuing mergers or acquisitions to gain scale, expand their client base, or acquire talent, leading to a consolidation wave even as new firms launch.

- In 2024, U.S. RIA mergers and acquisitions reached an all-time high, with roughly 366 deals announced during the year.

- The first quarter of 2025 alone saw 118 RIA transactions, the busiest Q1 on record.

- Over one-third of transactions in early 2025 involved acquisition targets with over $1 billion in AUM.

- Strategic acquirers (typically large RIAs with PE funding) made up 87% of all RIA deals in early 2025.

For smaller firm owners, this environment presents both increased competition and attractive opportunities. Some may choose to join forces with larger partners, while others double down on their independent niche.

RIA Client Expectations Statistics

Modern RIA clients increasingly demand full-service financial guidance beyond investment management.

As part of the advisor relationship, high-net-worth investors want help with all aspects of their financial lives: estate planning, tax strategy, insurance, and more.

- A 2025 survey found 70% of clients want their financial advisors to provide estate planning as part of a holistic approach, with 40% saying they would switch advisors for that service.

- An estimated $84 trillion in wealth is shifting to younger generations; 63% of Gen Z, 54% of Millennials, and 46% of Gen X investors are willing to change advisors to obtain integrated estate and legacy planning support.

An outstanding client experience is the baseline expectation. Clients today demand proactive, personalized communication and a deep understanding of their goals.

- Nearly half (47%) of clients with over $500,000 in assets say they want more frequent touchpoints, many preferring monthly check-ins rather than quarterly.

- 85% of high-value clients say more frequent or personalized communication would greatly improve their confidence in their advisor. 88% say it would influence their decision to stay with their advisor. 89% say it would affect how likely they are to recommend that advisor to family and friends.

- 78% of clients now expect “interactive” digital experiences from their advisors – meaning a static quarterly PDF or basic website is no longer sufficient.

Wealth clients also judge their advisors by the quality of their technology and online experience. Clients increasingly expect personalized, goal-centric tools and content.

- 44% strongly agreed in 2024 that they expect digital goal-planning guidance.

- Only 18% of full-service firms’ apps provide a valuable, proactive experience with features like interactive planning tools and tailored guidance that meet expectations.

Younger Investor Trends and Expectations for RIAs

With the impending Great Wealth Transfer, RIAs face a new generation of clients who have distinct expectations and will not hesitate to leave if those needs aren’t met.

- 81% of heirs plan to fire their parents’ advisor after receiving an inheritance.

- Nearly 85% of high-net-worth millennials say aligning investments with their values (ESG principles) is important and integral to their strategy.

- 73% of millennials regularly communicate with their advisor through digital channels (email, text, video chat) rather than traditional phone calls or in-person only.

As wealth shifts to younger clients, RIAs must adapt by forging multigenerational relationships and delivering the kind of high-touch, tech-enabled, purpose-driven experience these clients want.

CircleBlack gives advisors a fully customizable, mobile-first client portal that aggregates held-away assets, tracks progress toward goals, and delivers advisor-curated insights in one seamless experience.

Paired with AI-powered meeting prep and personalized reporting, CircleBlack empowers firms to elevate the client experience—especially for younger investors who expect simplicity, transparency, and digital-first engagement.

Statistics on AI Adoption at RIA Advisories

Current industry studies show that RIAs are embracing AI at unprecedented levels, with nearly all firms using it in some capacity and expanding into more operational, marketing, and planning use cases.

- 95% of RIA firms reported using AI, four times the adoption rate seen among bank/trust companies.

- 85% of financial advisors now view generative AI as a “help” to their practice (up from 64% in 2024).

- 76% of advisors report immediate benefits from using AI-driven tools in their work.

- Administrative and operational tasks are a primary focus of AI among firms (cited by 43% of firms).

- 38% of firms use AI to generate marketing content (e.g. blog posts, social media, newsletters), and 31% use it for drafting client correspondence and outreach.

- 29% of advisors use AI to help develop personalized financial plans, as most planners still prefer a hands-on approach for core advice, citing compliance concerns.

- 82% of advisors say their firm has a formal Gen AI policy, a significant increase from 47% in 2024.

RIA Technology Capabilities and Usage Statistics

RIAs continue to invest in the core tools that drive operational efficiency and client experience. Adoption rates are high across the most essential capabilities, with several showing notable year-over-year growth.

- CRM is positioned as the most essential system in an advisor’s toolkit—ranking #1 in importance among 27 tech categories with a 9.2/10 rating.

- 92% of advisor practices that offer financial planning use a general financial planning software solution.

- 67% of advisors now use an integrated technology stack versus stand-alone tools, up from 48% in 2022.

- Data aggregation and integration capabilities rank as the #1 factor in advisors’ technology selection, with advisors preferring tools that pull together held-away assets, banking data, and more into one holistic view.

RIA Technology Impact on Growth and Competitiveness Data

Now more than ever, technology is a decisive growth lever for RIAs in 2025, influencing client wins, retention, and firm competitiveness as much as investment performance.

- 93% of those with state-of-the-art systems reported winning clients from competitors with inferior technology.

- 58% of advisors reported losing new business due to poor technology.

- 92% of clients said they would switch firms over poor technology, and 44% have already done so.

- Industry benchmarking indicates that technology spending averages around 3–4% of firm revenue for RIAs.

- Firms under $250M AUM were 1.8× less likely to embrace technology best practices than firms over $1B+.

- Firms using platforms designed to enhance the digital experience were more than twice as likely to achieve AUM growth over 21%.

RIA Talent and Hiring Trends (2026 Outlook)

Hiring remains a top concern, especially as firms scale up service and client volume.

But with advisor retirements on the rise and succession planning lagging, many firms are unprepared for the operational strain ahead.

- In Schwab’s 2025 study, 78% of RIA firms said they were actively hiring in 2024 and recruiting skilled staff was the second-highest strategic priority.

- Even RIAs with over $1B AUM face capacity strains as they serve more clients with smaller accounts, underscoring the need for tech and process upgrades to improve efficiency.

- Approximately 37% of RIA advisors will retire in the next 10 years, representing ~35% of RIA assets, spurring M&A and succession-driven consolidation.

- Only 42% of RIA firms report having a written succession plan, the lowest level since tracking began in 2019.

Staffing gaps and succession risks are building across the industry.Firms that don’t address capacity and continuity now may struggle to maintain service levels as demand grows and senior advisors exit.

RIA Operational Costs and Revenue Data

As margins shrink and costs climb, financial efficiency for advisories is under the microscope heading into 2026.

- In 2024, smaller RIAs (<$1B AUM) saw operating margins hit historic lows as rising expenses, falling AUM per client, and lower revenue per advisor converged.

- Fidelity reported advisory expenses reached 82% of revenue in 2023, leaving only 18% operating margin – a record low margin and downward trend.

- The median firm’s revenue grew 18% year-over-year, fueled by market gains and new client inflows. Median assets under management grew 17% and median client count by 4.8%, indicating revenue per client also rose.

- 86% of firms rely on AUM fees as their primary method for charging clients. In fact, 92% of advisors incorporate AUM-based fees in some way (even if combined with other fees).

- Roughly 21% of advisors charge standalone financial planning fees (project-based or plan fees) as part of their revenue mix.

- About 16% of advisors who target sub-$100k clientele use monthly subscription fees.

RIA Growth Statistics and Key Drivers

Growth is up, but expenses are outpacing gains for many smaller firms, especially those without scalable tech or pricing flexibility.

- SEC-registered RIAs that primarily serve individual investors (rather than institutions) are relatively small, averaging 8 employees and $393 million in assets under management.

- Cerulli’s reports show “heavy” technology users (firms that extensively integrate tech) outperform light users in productivity, serving more clients per advisor.

- Nearly 30% of heavy-tech practices achieved above-average growth over the past 3 years, versus only 9% of firms with low tech adoption.

- Time remains the biggest hurdle to growth, with 51% of advisors stating administrative overhead and time on small accounts as top barriers to their firm’s growth. Revenue growth is still strong, but it’s not translating evenly into profit.

The gap continues to widen between firms investing in tech with scalable systems, and those stuck with rising costs and flat margins.

CircleBlack’s pre-built compliance workflows and one-click multi-custodian reconciliation remove hours of manual work each week, letting firms handle more assets and accounts without adding headcount.

Positioning Your Advisory to Earn New Clients in 2026

The independent RIA space is growing, but so are the expectations.

Clients want more than portfolios. They expect personalized advice, digital experiences, and advisors who can guide multigenerational wealth, not just manage it.

That bar isn’t going down.

To protect your margins, your team, and your growth strategy, you need a balance of strategy, skills, and technology. The firms winning in 2026 are the ones that turn technology from a cost center into a growth multiplier.

The top advisory firms consistently:

- Spend 25% less time per client on ops

- Gain 3.8x more assets from existing clients

- Achieve 2.6x client growth CAGR, 3.1x net flow growth

- Use CRM and digital workflows much more deeply

CircleBlack makes this easiest for RIAs.

Our platform brings your tools, data, and workflows into one place—so you can spend fewer hours managing systems and more time growing your advisory.

Disclosures: This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal, or tax advice.